by jordant | Mar 17, 2025 | Current Real Estate Trends and Updates, Mortgage Rates

It has become the recurring theme in the Canadian economy: the on-again, off-again trade war with the United States. And in the tradition of hoping for the best and preparing for the worst the Bank of Canada is using the one weapon it has, interest rate policy. Last...

by jordant | Dec 11, 2023 | Mortgage Rates

READ ALL ABOUT IT HERE The Bank of Canada has held its trendsetting interest rate at 5.0% for a third straight setting and talk of further increases has been all but silenced. In the statement that came with the most recent rate announcement, The Bank offered a number...

by jordant | Nov 22, 2023 | Mortgage Advice, Mortgage Rates

https://www.facebook.com/646287120/videos/286457907107275/ Your mortgage is up for renewal and the interest rate you’re being offered is a lot higher than expected and going to put your finances in a pinch. Are there any other options? There may be! If you have...

by jordant | Aug 21, 2023 | Current Real Estate Trends and Updates, Mortgage Rates

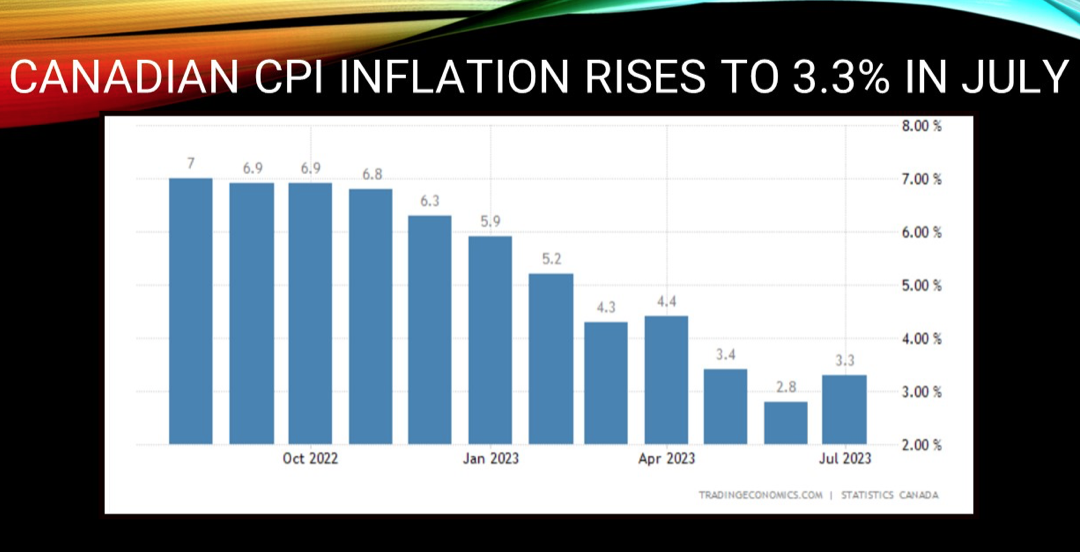

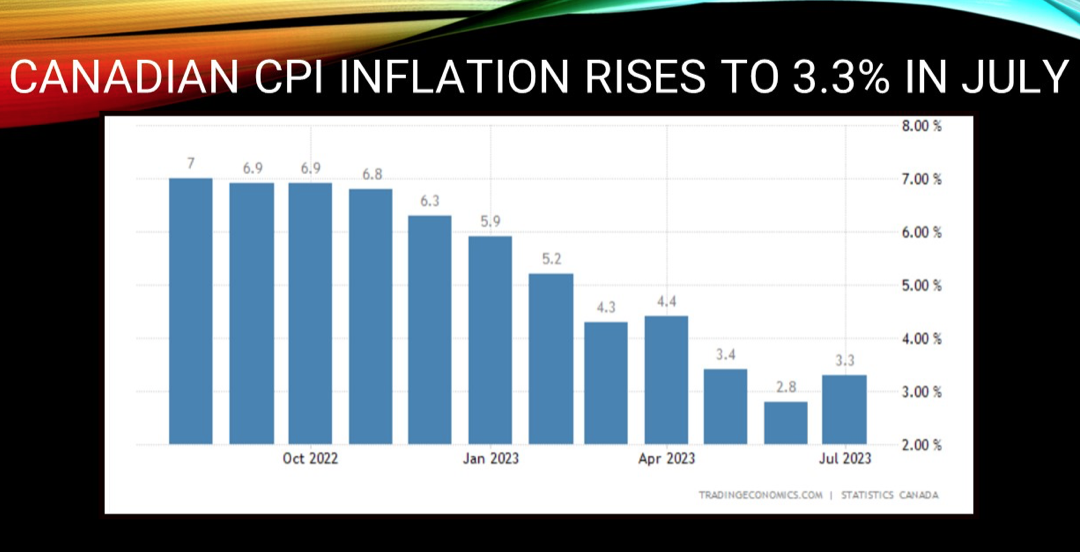

July Headline Inflation Rose to 3.3%, But Core Inflation Improved The Consumer Price Index (CPI) rose 3.3% y/y in July, up from a 2.8% rise in June. The acceleration in headline inflation was widely expected due to a base-year effect on gasoline prices, as a sizeable...

by jordant | Feb 18, 2023 | Current Real Estate Trends and Updates, Mortgage Rates

CHECK OUT THE VIDEO HERE! 2023 is underway! After an uncertain and tumultuous past year with the economy, mortgage rates and the real estate market, where are we now and what is expected in the coming months?? Higher interest rates continue to impact our real estate...

by jordant | Dec 20, 2022 | Current Real Estate Trends and Updates, Mortgage Rates

What a year it’s been!! Here is my 2022 Round Up of the 5 Top Mortgage Stories as I see it and what could be in store for 2023. 1) BOC raises rates 400 basis points, the steepest rise in one year since 1936 2) Variable Rate Mortgage Pain, Trigger Rates and...

Recent Comments